I recently realized something that completely reframed how I think about income in America: a $200,000 household income is no longer middle class. In fact, under increasing college financial aid formulas, earning up to $200,000 now qualifies as lower income or even poor. New data shows families at this income level can receive free or heavily subsidized tuition at elite universities.

Being labeled “poor” doesn’t sound great. So does being labeled “lower class,” hence the use of lower income. But if $200,000 is the new poor, there are suddenly real advantages to earning less for families.

I’ve long believed the middle class is the best class in society. You’re not attacked for being greedy like the rich often are, and you’re not dismissed as lazy or incompetent like the poor sometimes are. Politicians chase you because you’re the largest voting bloc. As a result, middle-class earners can move through society with fewer judgments and less friction.

There’s power in being part of the majority. That’s why I’ve always said: if you earn a middle-class income, rejoice! You are loved and protected. And if you earn a high income, pay massive taxes, and grind through endless hours at work, you should seriously question whether the tradeoff is still worth it.

When I went from a high income in finance to zero active income in early 2012, I became technically poor. Yet it felt like an enormous weight had been lifted. I was burned out and desperate for a break. No longer working five months of the year just to keep a dollar of what I earned after sixty-hour workweeks was liberating.

Despite earning nothing, I was free. That freedom came only after 13 years of saving over 50% of my after-tax income and saying no to countless temptations. Today, I’m starting to wonder whether being “lower income” might actually be better than being middle class, thanks to expanding benefits, less social pressure, and the possibility of a far healthier work-life balance.

$200,000 Is The Lower Income Limit According To Yale

On January 27, 2026, Yale University announced it will offer free tuition to students from families who earn less than $200,000 a year. For students from families earning under $100,000, essentially all costs associated with attending Yale (room and board) will be covered.

Although roughly 96 percent of students who apply to Yale will not be admitted, this is fantastic news for those who are and whose families fall under these income thresholds.

In effect, Yale has determined that any family earning up to $200,000 is lower income, or poor. I am sure Yale will also consider family size and adjust thresholds accordingly. After all, it is far easier to support one child on $200,000 than it is to support four.

At the same time, Yale is implicitly signaling that families earning less than $100,000 are considered too poor to afford even one dollar toward college. After spending eighteen years providing food and shelter for your children, Yale now believes it is their responsibility to cover your adult child’s living expenses. Awesome!

While it may sound strange to describe a six figure income as lower income or poor, I have written several articles with detailed budgets showing how difficult it is to get ahead in major cities earning $200,000 or even $300,000 a year. Many readers objected to my conclusions, but it is validating to see the institutions closest to the money agree that $200,000 isn’t that much money for a family to survive on.

How Assets Are Considered By Yale And Other Institutions Is Unclear

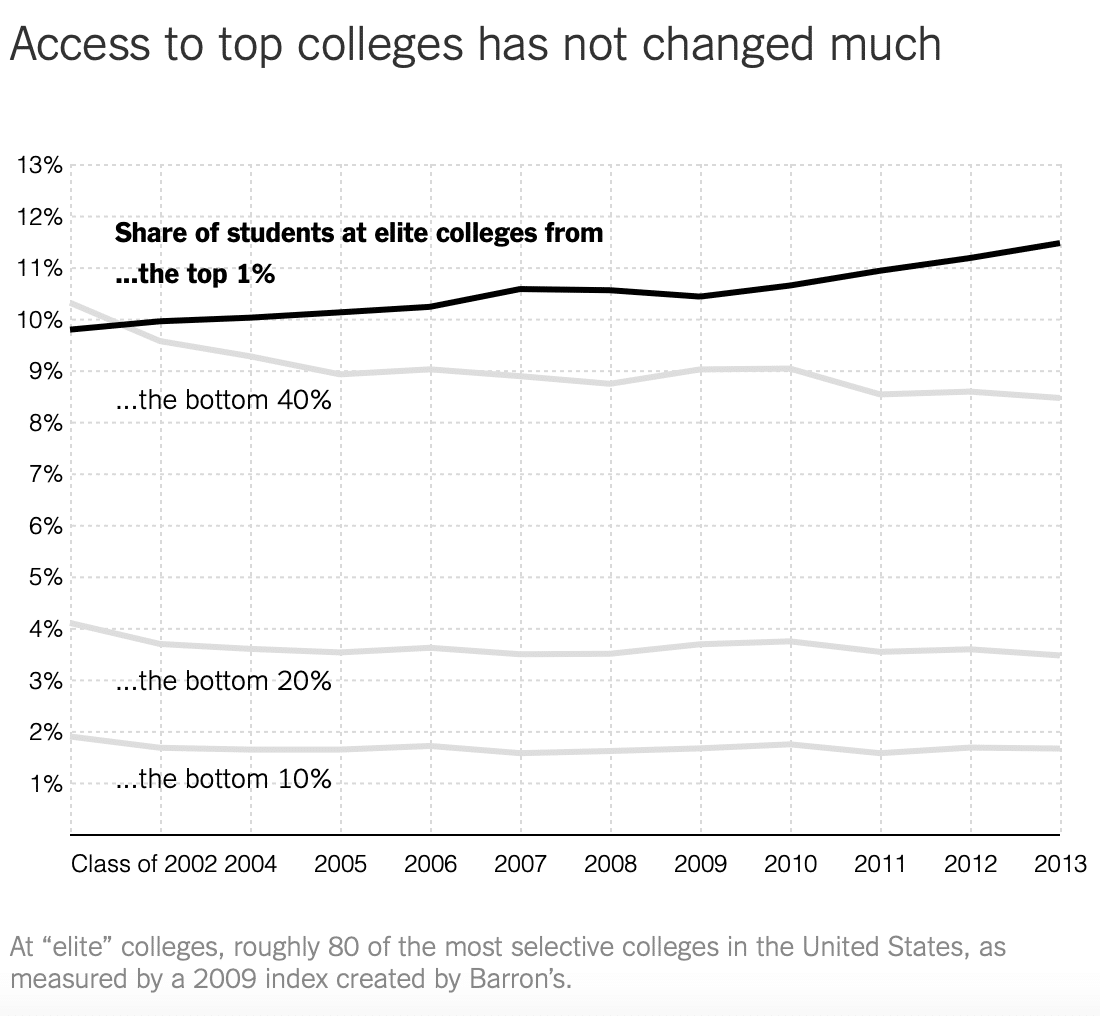

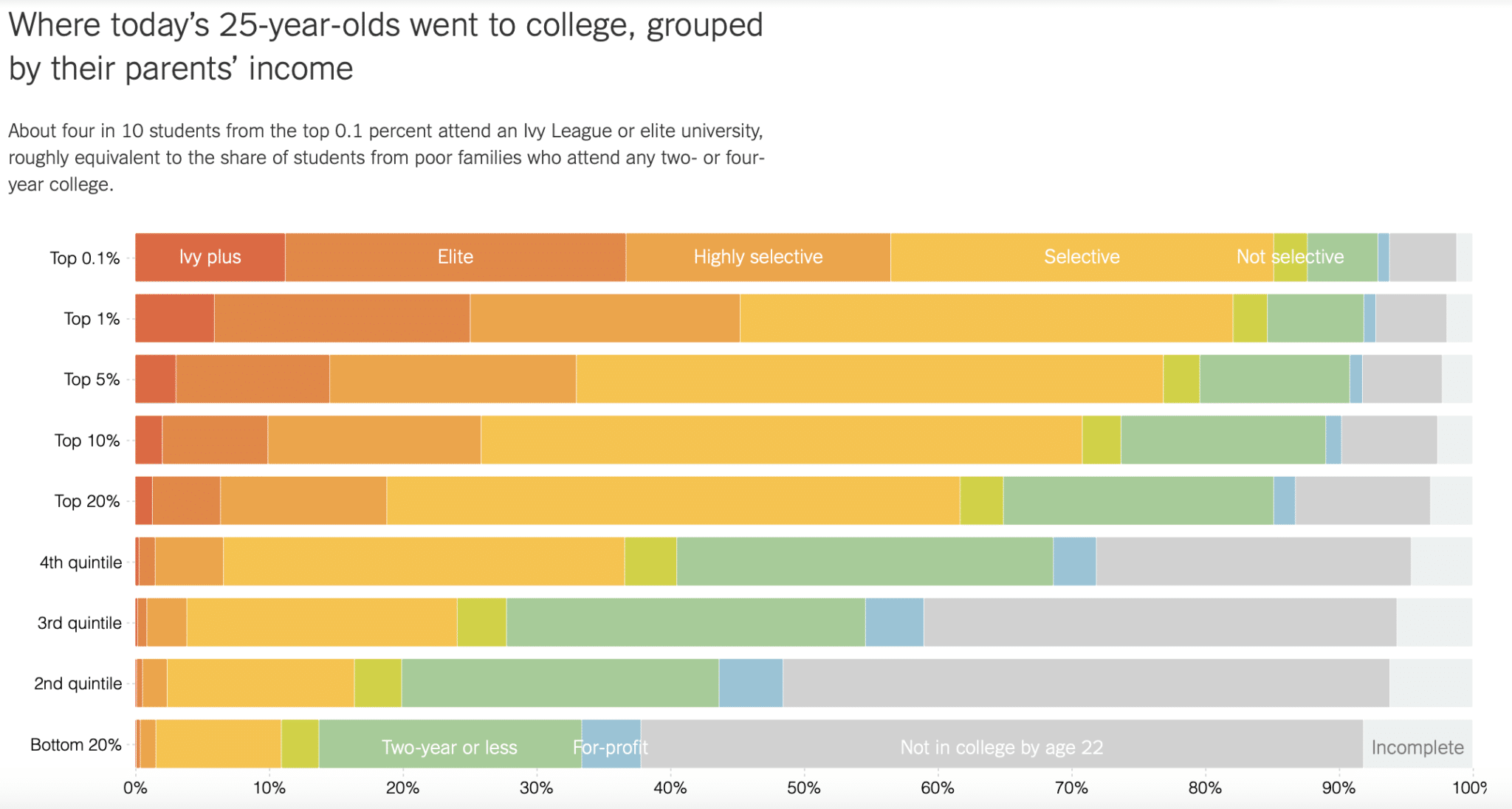

Even though a disproportionate number of students at Yale and other Ivy League universities come from high income households, this move is still a generous gesture and brilliant marketing. Most people will be surprised to see $200,000 defined as lower income.

As personal finance enthusiasts, however, we understand that net worth and investments matter far more than income when it comes to achieving financial freedom.

The definition of FIRE I proposed in 2009 when I launched Financial Samurai is simple. The ability to generate enough passive income to cover basic living expenses. If you can live off $25,000 a year in passive income you are financially independent. If your passive income is $300,000 a year but your expenses are $400,000 a year, you are not.

The goal is to make your money work for you so you have the option not to work. Further, investment income is generally taxed at a lower rate than W2 income, as it should be, since that money has already been taxed.

When I read Yale’s announcement, I could not determine how assets factor into financial aid decisions. At some institutions, a primary residence is counted. At others, it is excluded.

What about parents who diligently saved into a 529 plan for eighteen years and accumulated enough to pay for all four years of tuition while earning only $160,000 a year? Do their admitted children get free tuition or should they be expected to pay something? The questions are endless.

Below is an excerpt from Yale’s announcement that offers broad statements but few specifics.

By raising the threshold (for zero parent contribution) to $100,000, nearly half of all American households with children ages six to seventeen would now qualify for a financial aid package that does not require parents to contribute anything toward a student’s education. Under the new policy for families earning under $200,000, more than 80 percent of American households would be eligible for a Yale scholarship covering at least the cost of tuition.

Today, more than 1,000 Yale College students receive a zero parent share award, and 56 percent of all undergraduate students qualify for need based aid. The average grant for students receiving aid this academic year exceeds the annual cost of tuition.

Yale also provides additional grants for winter clothing, summer experiences abroad, and unexpected financial hardships.

Lucky for you, I have two comprehensive articles that explain how to pay for college and how to get free money for college. If you do not have the time or patience to navigate it on your own when the time comes, there are also consulting firms that help families save money or maximize their college financial aid offers.

Focus On Building Net Worth, Not Income

If you can find clear details on how assets are treated under these new income thresholds, I would love to see them. I could not find any. If you are a college financial aid officer, please share your insights!

What is clear is that Yale and other elite private universities emphasize income over assets when defining financial need. The same framing dominates political discussions around taxes. Income is easier to grasp and easier to message. But if we must continually trade time for money, we will never be free.

That is why I believe focusing on building a high net worth is far superior to chasing a higher income. As income rises, taxes rise under a progressive system. Once you reach a marginal federal rate of 25 to 30 percent, you may begin to question whether the extra effort is worth it. And if you disagree with government policies or see waste and fraud in your community, your motivation to work harder just to pay more taxes may fall even further.

If your family earns less than $200,000 a year, feel good about your future. You are earning enough to raise a couple of children comfortably in most parts of the country. Even earning $150,000 – $200,000 with two kids in New York City or San Francisco is manageable if you avoid private school tuition.

And if your children happen to be exceptionally talented or gifted, they may even attend a top university for free, tremendously alleviating your financial burden.

Attracting Top Talent Is Competitive For Colleges Too

While many families fixate on how hard it is to gain admission to top universities, from the schools’ perspective, competition for the best students is intense as well.

With Yale offering free tuition up to $200,000 of household income, other elite universities will almost certainly follow to remain competitive. Less competitive private colleges will need to offer even more generous incentives to attract top students. This is great for all middle-class families.

Within the higher education ecosystem, the universities with the largest endowments will continue to dominate. It is impossible for a fantastic public institution like The College of William and Mary with a $1.5 billion endowment to compete with Yale’s roughly $40 billion endowment. In a final twist of irony, the rich get richer. And that is likely how it will remain unless someone or some institution deliberately intervenes to level the playing field, if only for a little while.

Readers, do you agree that $200,000 is the new threshold for what constitutes a lower income, lifestyle, or family? Is a household income of $100,000 effectively poor when compared with $60,000 plus in annual after tax tuition at private universities? And do you agree that the middle class is the best class in the world?

Stay On Top Of Your Finances To Pay For College

To maximize your college financial benefits, you need to start planning by your child’s freshman year of high school, if not earlier. Colleges will look back at your family’s financial history for at least two years, and sometimes longer.

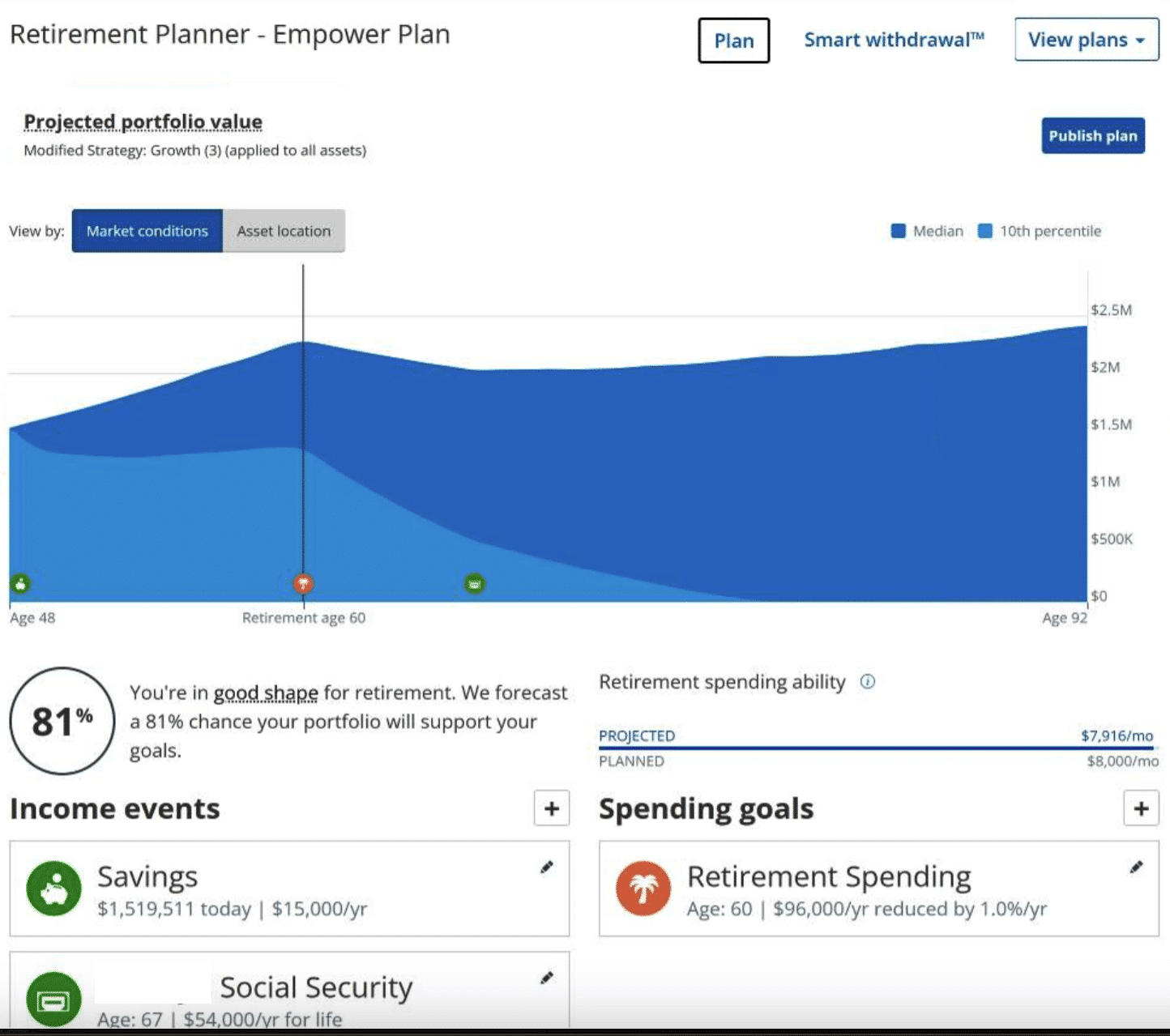

One tool I’ve consistently relied on since leaving my day job in 2012 is Empower’s free financial dashboard. It remains a core part of how I track net worth, monitor investment performance, and keep cash flow honest.

Through Empower, you can also get a complimentary portfolio review and analysis if you have more than $100,000 in investable assets linked. You’ll gain clearer insight into your asset allocation, risk exposure, and whether your investments truly match your goals for the years ahead.

Small improvements today can meaningfully compound into greater financial freedom over time. You need to understand what financial levers to pull to maximize your chances of getting free financial aid.

Empower is a long-time affiliate partner of Financial Samurai. Further, I did some part-time consulting for them in person from 2013-2015. Click here to learn more.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. You can also get my posts in your e-mail inbox as soon as they come out by signing up here. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009.

Read the full article here