If you’re a personal finance enthusiast with kids, you’ve probably wondered: at what household income level will colleges stop offering scholarships and grants (i.e., free money) to help your child attend? What is that income cutoff?

Given that the cost of college is already outrageous — and likely only getting worse — this is a valid and important question. The biggest joke of all? At this rate, you’ll need to be a millionaire just to afford four years at a private university, with the total cost approaching $1 million!

Thanks to an analysis by Bloomberg in an article titled Top Colleges Are Too Costly Even for Parents Making $300,000, we now have a rough answer. The research, conducted by Ann Choi, Francesca Maglione, Paulina Cachero, and Raeedah Wahid, highlights how America’s “middle class” is increasingly being squeezed out of elite college affordability, with little recourse but to opt out.

As a parent of two, neither of whom I believe have a snowball’s chance in hell of getting into a top-50 university, I’ve already mentally prepared for the more practical route: public university or community college for the first two years. However, Bloomberg’s article points out that even public universities might not necessarily be much cheaper, depending on your household income.

Let’s explore this critical and fascinating topic.

Household Income Limit for Receiving Free Money from Colleges

According to Bloomberg’s analysis, once a household’s income reaches $400,000, families should no longer expect to receive any scholarships or grants. In other words, households earning $400,000 or more are generally expected to pay the full sticker price. Roughly 50% of families at these elite private universities are already doing so.

I think it’s great that private colleges are trying to make higher education more affordable for more families. Getting to pay half price if your household makes around $225,000 a year isn’t a bad deal. After all, $225,000 provides a comfortable middle-class lifestyle for a family of four living in a non-coastal city.

Unfortunately, colleges don’t seem to take into account the cost-of-living differences households face across the country. Earning $225,000 in San Francisco or New York City provides a significantly lower quality of life than earning the same amount in Des Moines. If colleges could take that next step and factor in a cost-of-living adjustment (COLA), that would be lovely.

From the article:

At USC, families that make around $180,000 are expected to pay anywhere from 22% to 33% of their income towards tuition, or roughly $50,000 on average — the largest financial burden out of the schools in Bloomberg’s analysis, each of which uses the MyinTuition calculator.

A family with the same financial profile is expected to contribute 13%, or $24,000, towards the annual tuition at MIT.

At Williams College, a student with $300,000 of family income would be asked to pay from $43,000 to $73,000 a year toward the roughly $92,000 sticker price. The same student qualifies for little to no relief at Harvard, where tuition is around $87,000 a year, according to the analysis.

Thanks to the Bloomberg article, hopefully it’s now clear to everyone that earning $300,000 a year is considered a middle-class income in many parts of the country. I was raked over the coals in the comments section of my article, despite having a clear and realistic household budget. But folks are finally coming around!

It’s Not as Simple as Earning Less Than $400,000 to Get Free Money for College

At first glance, staying under $400,000 in household income sounds easy. After all, $400,000 puts you in the top 3% of income earners in America, meaning about 97% of households earn less. Yay — most of us should get free money for college, right? Wrong.

What the Bloomberg article overlooks is the impact of assets. In the personal finance world, net worth matters more than active income. One day you could be earning a high salary, and the next you could be out of a job. However, once you build a large enough net worth, you can generate enough passive investment income to live freely forever.

Perhaps Bloomberg’s narrow focus on income alone reflects broader societal trends. After all, the average savings rate in America hovers around just 5%. Our society prioritizes aggressive consumerism over disciplined saving and investing. According to the latest Survey of Consumer Finances, the median net worth in America is only about $192,000.

Bloomberg may be assuming that the typical American family doesn’t build a rental property portfolio, doesn’t open a custodial investment account (UTMA), and doesn’t save in a 529 college savings plan — and they might be right!

Case in point: I recently spoke to a friend who manages money professionally and has an MBA from Harvard. He has two kids, ages 5 and 8 and he had no idea what a 529 plan even was!

Your Assets Matter When Applying For Financial Aid For College

When filling out the FAFSA (Free Application for Federal Student Aid), the assets that count against a family (i.e., are considered available to help pay for college and can reduce financial aid eligibility) generally include:

Assets that FAFSA Counts:

- Cash, savings, and checking account balances

- Investments, including:

- Stocks

- Bonds

- Mutual funds

- Certificates of deposit (CDs)

- Cryptocurrency

- Real estate (but not the family’s primary home — see more below)

- College savings accounts, like 529 plans (if owned by the parent or student)

- Trust funds

- UGMA/UTMA accounts (student-owned accounts)

- Businesses and farms (only if they have 100+ full-time employees or are investment businesses)

Assets that FAFSA Does Not Count:

- Primary residence (family home equity is excluded so buy the nicest house you can afford)

- Retirement accounts, such as:

- 401(k)s

- IRAs (traditional and Roth)

- Pensions

- Annuities

- Life insurance policies

- Personal possessions (like cars, furniture, jewelry)

Additional Notes:

- Parent assets are assessed at a much lower rate than student assets.

- About 5.64% of parent assets are considered available for college costs.

- About 20% of student assets are counted, which is much harsher.

- 529 plans owned by parents are treated as a parent asset (better).

- 529s owned by grandparents (under the old FAFSA rules) could mess things up when distributions happen, but starting with the 2024-2025 FAFSA, those distributions are no longer reported as untaxed student income.

The More Assets You Have, the Less Free Money You Get for College

If your household of four earns $80,000 a year but has a $5 million taxable brokerage account, $200,000 in cash, a $2 million rental property portfolio, and $300,000 in each child’s 529 plan, you’re unlikely to get any free money for college.

Don’t even bother trying to manipulate your income lower. Give up! Your years of diligent saving and investing have earned you the “privilege” of paying full sticker price. You can’t hide your assets to make yourself look poorer — and if a school finds out you tried, your child’s admission offer could get rescinded.

All elite private universities go beyond the FAFSA and require the CSS Profile to evaluate whether your household qualifies for need-based financial aid. The CSS Profile is much more thorough because it distributes money from the colleges’ own funds, not from the federal government.

If you are income poor and asset rich, you lose when it comes to getting free financial aid for college.

What About Going to Public College to Save Money?

As a graduate of The College of William & Mary, a public school in Virginia, I’ve long been a strong advocate for attending public college to save money. When I went, my parents paid just $2,800 a year in tuition, while private universities were charging around $20,000.

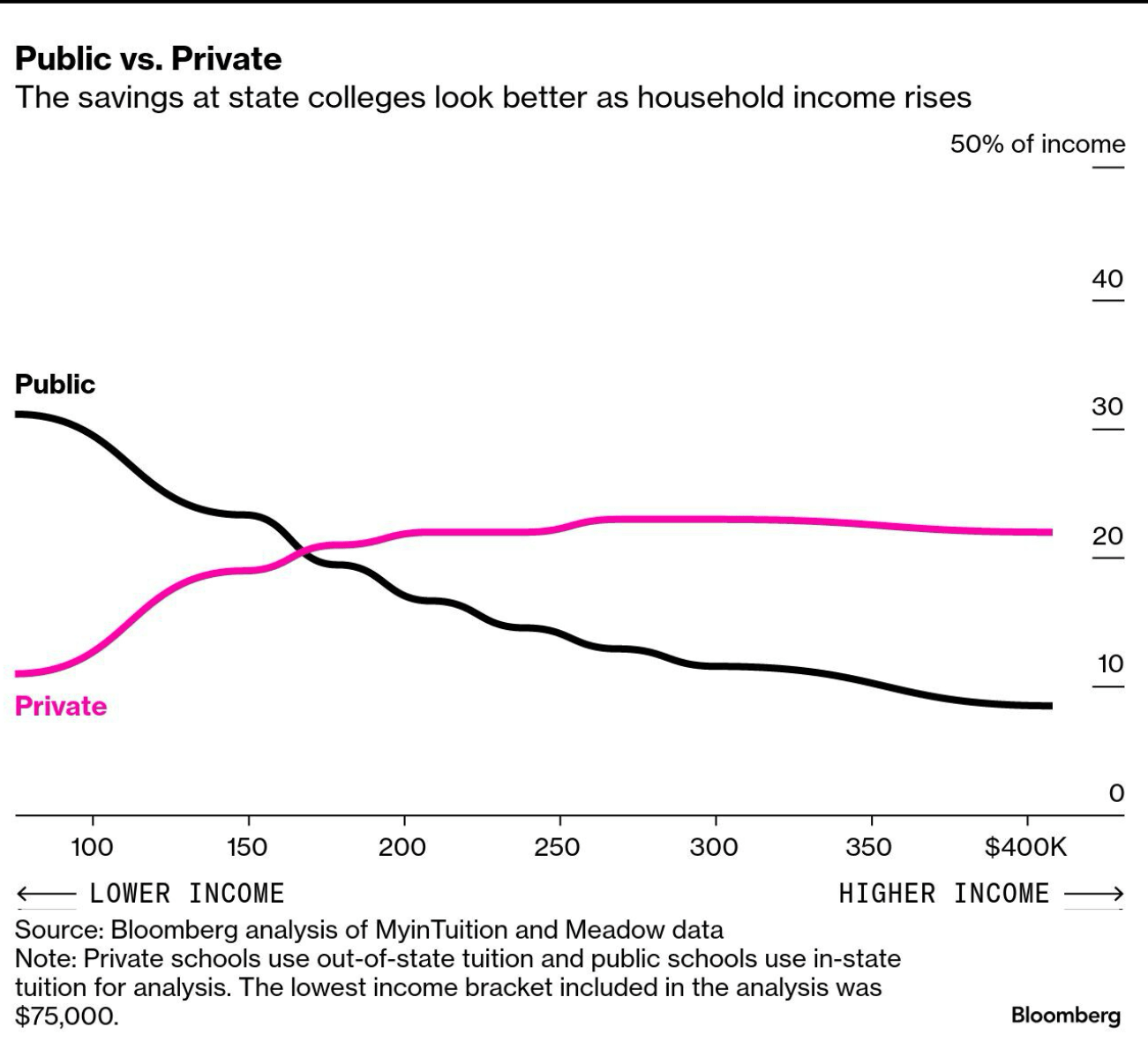

However, attending a public college to save money over a private one may not be as straightforward today. According to Bloomberg’s analysis, once your household income exceeds roughly $170,000, it could actually be cheaper to send your child to a private university.

The reason? Private colleges often have more resources and are more willing to offer financial aid, while public colleges expect families to contribute more once they cross certain income thresholds.

Personally, I think what will likely happen for my kids is that they’ll either attend a public college or go to a tier 2 or 3 private college with “merit aid.” I put “merit aid” in quotes because many colleges are now giving out money under the guise of merit to make families feel good and incentivize enrollment.

Don’t Be Middle Class When Applying for College Grants and Scholarships

Hopefully, it’s clear from this analysis that when applying for college, you either want to be poor or a multi-millionaire.

If you’re poor, you’ll likely get significant free money for college, which is fantastic. Please take full advantage. A college education is still one of the best ways to break out of the poverty cycle.

If you’re a multi-millionaire, you probably won’t qualify for need-based grants or scholarships. But the sting of paying full price won’t feel as painful because you’ll have enough assets saved up, and possibly a high income as well. If you’re lucky, your child might even receive need-blind merit aid, which is essentially a discount to encourage them to enroll.

Unfortunately, if you’re a millionaire with a net worth under ~$5 million, paying $100,000+ per year for four years for just one child will still hurt. Ideally, you’d want a net worth of at least 25X for the cost to no longer feel painful.

In other words, if you want to send your kid to NYU or USC for $400,000 total, you’d need at least a $10 million net worth to feel financially comfortable doing so. How crazy is that? Pretty soon, going to a private college will only be a luxury for the very rich or the extremely talented.

The middle-class household earning between $150,000 to $400,000 a year will feel the most pain when paying for college. Unless you’re a legacy student, athlete, or part of a special interest group, affording college comfortably will likely be tough. And you can’t count those advantages as they aren’t in your control.

Readers, what are your plans to make college more affordable? Why do you think Bloomberg and others not take into consideration assets when doing their analysis? Are we really just a nation of spenders who don’t save and invest aggressively for the future?

Become a Millionaire to Afford a Million-Dollar College Degree

It’s ironic that households now need to become millionaires because the total cost of college is heading toward a million dollars all-in. But the math doesn’t lie. You can either take matters into your own hands by building serious wealth, or pray for the kindness of others in this brutally competitive world. I choose the former.

If you want to have an easier time paying for college, pick up a copy of my new book, Millionaire Milestones: Simple Steps to Seven Figures. It would be a crying shame for your child to get into their dream school but not be able to attend because you weren’t wealthy enough. The more money you have, the more options — and freedom — you and your children will have.

If you love personal finance, join 60,000+ others and sign up for my free weekly newsletter. Since 2009, my goal is to help readers achieve financial freedom sooner so we can do more of what we want.

Read the full article here