The maximum employee 401(k) contribution limit for 2026 is increasing by $1,000 to $24,500 according to the IRS. For workers over 50, the catch-up contribution rises to $8,000, bringing the total to $32,500. That’s a substantial amount of money to shelter in a tax-advantaged account each year.

When I first started working in 1999, the employee 401(k) limit was only $10,000. Despite earning just $40,000 in base salary my first year I still contributed about $3,000. And then, when I got a raise to $55,000 in 2000, the limit was still only $10,500, so I maxed it out.

I kept maxing my it out until I left my job in 2012, walking away with roughly $300,000 in my 401(k). My returns were mediocre mainly thanks to the 2000 dotcom bust and the 2008–2009 global financial crisis. However, $300,000 at age 34 still felt like a meaningful financial foundation.

Along the way, I built a small rental property portfolio, accumulated CDs, and invested in a taxable brokerage account. With those income streams, I felt comfortable enough to leave my job, especially after I negotiated a severance package.

I’ve always treated my 401(k) as “bonus money.” I maxed it out to reduce my taxable income and forced myself to live within my means. If the money shows up for me after age 60, fantastic. But like Social Security, I’ve never counted on it. Depending on the government to live your life is not a good strategy.

The 2026 401(k) Employer Contribution Matters

I’m thrilled about the higher $24,500 employee limit. But when you add in employer matching and profit-sharing, the total amount that can go into your 401(k) for 2026 is up to $72,000 (or up to $80,000 if you’re 50 or older). In other words, your employer could contribute up to $47,500. That’s significant!

So if your employer only offers something like a $3,000 match for contributing $3,000 yourself, just know they could contribute far more if they wanted to (and if the company had the profits). The ceiling is much higher than most employees realize.

For those of you intrepid enough to grind at startups for years, just remember: you could be giving up hundreds of thousands of dollars in easy money through employer 401(k) contributions. So bake that into your calculus when deciding whether to work 35 hours a week earning $500,000+ at Google, or 70 hours a week earning $160,000 at a startup. Big tech — or any large, established company — might quietly drop $10,000+ into your 401(k) every year just for showing up.

During my final three years at Credit Suisse, I was getting $15,000–$20,000 a year in employer profit-sharing contributions to my 401(k) as a Director (one level above VP). And Credit Suisse wasn’t even as profitable as many larger banks or big tech firms. In fact, Credit Suisse got swallowed in 2023 because it was heading to bankruptcy 11 years after I left.

Surely your employer can do better if you have more than 13 years of work experience!

Contributing the Maximum 401(k) Employee Amounts Will Make You a Millionaire

With the new $24,500 employee limit, I’m confident that anyone who consistently maxes out their 401(k) will become a 401(k) millionaire within 20 years. Below is a table showing future 401(k) values after 10, 15, 20, 25, and 30 years of max contributions, using return assumptions of 5%, 7%, 10%, and 15%.

| Years | Return | Future Value |

|---|---|---|

| 10 | 5% | $307,828.98 |

| 10 | 7% | $338,949.30 |

| 10 | 10% | $389,747.54 |

| 10 | 15% | $481,305.51 |

| 15 | 5% | $543,632.81 |

| 15 | 7% | $635,671.07 |

| 15 | 10% | $770,165.67 |

| 15 | 15% | $1,060,516.51 |

| 20 | 5% | $859,970.48 |

| 20 | 7% | $1,047,466.59 |

| 20 | 10% | $1,388,897.41 |

| 20 | 15% | $2,299,405.30 |

| 25 | 5% | $1,283,691.23 |

| 25 | 7% | $1,679,037.12 |

| 25 | 10% | $2,430,566.83 |

| 25 | 15% | $4,823,277.02 |

| 30 | 5% | $1,848,434.00 |

| 30 | 7% | $2,646,060.65 |

| 30 | 10% | $4,271,083.91 |

| 30 | 15% | $9,977,106.61 |

After getting my Empower financial review, I decided to run my own deep-dive calculation on my historical 401(k) performance. Despite contributing for only 13 years while earning a dismal <4% compound annual return, my balance still grew to about $300,000 when I left my job in 2012. I didn’t touch it afterward.

To my delight, that same $300,000 snowballed into almost $1.6 million just 13 years later, with zero additional contributions. That’s the power of compounding when the market finally cooperates. I was all in on equities, mostly tech stocks, because I treated my 401(k) as bonus money.

And here’s the thing: If I had kept working and maxed out my 401(k) from 2012 to 2025, using the same compound annual growth rate. my 401(k) balance would be roughly $2,554,000 today.Oh man, another $1 million would hit the spot. I could sit back, stare at the funny money on my screen, and daydream even harder about the life of a free man.

But that extra million would also have cost me 13 more years of ~50-hour weeks, office politics, morning alarms, nonstop bi-weekly travel, and constant stress. Given how much life I’ve been able to live since 2012, the trade-off still feels worth it.

Please Max Out Your 401(k) Every Year

If you’re employed and you have access to a 401(k), please max it out every year. If not for your own retirement future, then do it for me! Fewer and fewer people have workplace retirement benefits these days, let alone employer matching. If you’ve got it, don’t waste it.

At this point in my life, if I wanted to contribute to a tax-advantaged 401(k) again, I’d basically need to go back to corporate consulting, do more private personal finance consulting, teach tennis, or drive for Uber. And even then, I wouldn’t have access to employer matching. Many workers today are incredibly fortunate in comparison.

At 48 years old now, it won’t be long until I can access my 401(k) and rollover IRA penalty-free. And although I still view these accounts as bonus money, the balance has grown large enough to fund a comfortable middle-class lifestyle after 59.5. At a 5% withdrawal rate, plus roughly 70% of estimated Social Security benefits starting at 62, I’m looking at over $110,000 a year in gross income in today’s dollars.

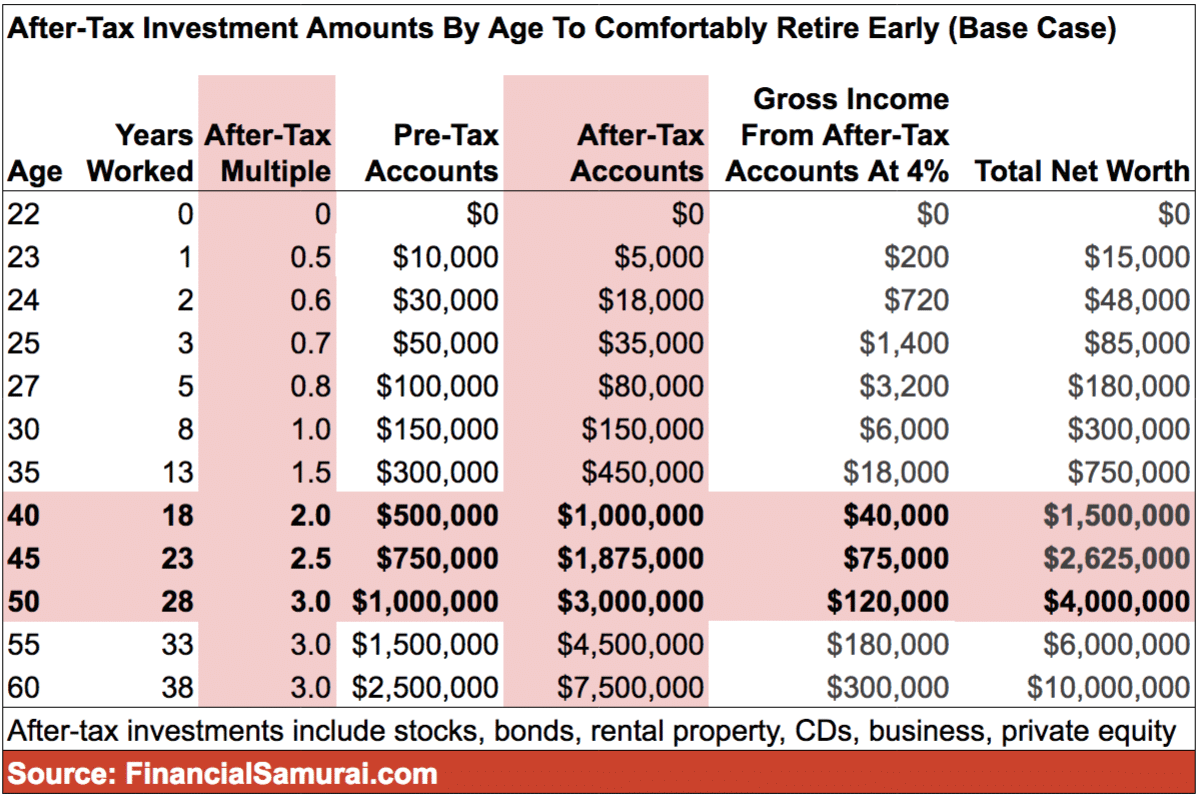

Build Your Taxable Accounts If You Want To FIRE

If you want to FIRE, simply contributing to an IRA or 401(k) won’t cut it. For 2026, IRA contribution limits rise to $7,500, or $8,600 if you’re 50 or older. Helpful, but not life-changing.

As you accumulate 7-figures in your 401(k), you must also prioritize building your taxable investment portfolio. This is the portfolio that will generate the passive income you can actually use before age 59½. Without it, early retirement becomes a lot more stressful and a lot less free.

If you don’t build a large enough taxable portfolio or rental property portfolio, you may find yourself scrambling for income after you leave your day job.

- You might end up starting a FIRE podcast and asking for donations during COVID.

- You might pressure your spouse to keep working for years even though you have two young kids and she desperately wants a break.

- Or, on the flip side, you might skip having kids altogether—even if you want them—because you feel financially constrained.

The lesson is simple: don’t rely on your 401(k) or the government for anything. If you want to maximize your lifestyle before age 59½, you must aggressively fund your taxable investments.

Once you hit 59½, you can withdraw from your 401(k) penalty-free. But remember, this is tax-deferred money. Every withdrawal is taxed at ordinary income rates.

The larger your 401(k) grows, the more strategic you’ll need to be with your withdrawals. That’s why contributing to a Roth IRA when you can, or doing a backdoor Roth IRA during low-income years, remains a smart financial move.

How to Consistently Max Out Your 401(k)

Here are some practical, realistic ways to make sure you hit the employee limit each year:

1. Automate Your Contributions

Set your contribution rate so you max out automatically, ideally starting in January. Once it’s out of your paycheck, you won’t miss it. Hedonic adaptation works both ways. You’re not really sacrificing, because the freedom you gain on the back end is far more valuable than any material thing you could buy today.

2. Increase Contributions With Every Raise

If you get a 3–5% raise, redirect at least 1–2% of it into your 401(k). You’ll maintain your lifestyle while boosting your savings rate. Remember: if the amount of money you’re saving each month doesn’t hurt, you’re not saving enough!

3. Use Bonuses Strategically

If your employer allows percentage-based withholding from bonuses, crank that percentage up. Even a single bonus can get you halfway to the max.

4. Keep Your Investments Simple.

For 95% of workers, an index target date fund, S&P 500 index fund, or total market index fund is more than enough. Low fee -> higher returns -> bigger nest egg. For the first 10–15 years, your contributions will matter the most. But once your 401(k) reaches around $250,000, you’ll start seeing more years where your investment returns exceed how much you can contribute.

5. Understand Your Employer Match Formula

Many employees miss out on free money simply because they contribute unevenly throughout the year. If your plan has “true-up” matching, great. If it doesn’t, make sure you’re contributing steadily enough to capture each pay-period match.

If you can’t max out your 401(k) each year, you better at least contribute up to the maximum 401(k) employer match. Never pass up free money!

A Final Word: Your Future Self Will Thank You

The 401(k) is one of the most powerful wealth-building tools available to everyday workers. The tax advantages, automation, employer match, and long time horizon create the perfect recipe for millionaire status, often faster than most people expect.

I’ve lived both sides:

- The “max it out every year” side

- And the “stopped contributing and watched it grow anyway” side

If you have the ability to max out your 401(k), do it. Your future self will never regret it.

Combine a maxed-out 401(k) with a steadily growing taxable portfolio, and you’ll put yourself in a position of true financial independence decades ahead of schedule.

Readers, what do you think of the 2026 401(k) maximum contribution levels for employees and employers? Don’t the amounts feel impressively large now? What’s preventing you or others from maxing out your 401(k) contributions each year? Have you reached 401(k) millionaire status yet? If so, how long did it take to get there?

Stay On Top Of Your Finances Like A Hawk

If you’re serious about maxing out your 401(k) and building real wealth, staying organized is half the battle. One tool I continue to rely on is Empower’s free financial dashboard, which I’ve been using ever since I left my day job in 2012. It’s still part of my regular routine for tracking net worth, investment performance, and cash flow.

My favorite feature is the portfolio fee analyzer. Years ago, it revealed I was paying roughly $1,200 a year in hidden investment fees I had no idea I was paying. The money that now stays in my pocket and compounds for my future instead of someone else’s.

If you haven’t reviewed your investments in the past 6–12 months, now’s the perfect time—especially if you’re thinking more strategically about retirement contributions for 2026 and beyond. You can do a DIY checkup or get a free financial analysis through Empower. Either way, you’ll likely uncover insights about your allocation, risk exposure, and investing habits that can lead to much better long-term results.

As always, stay proactive. A little optimization today can translate into far greater financial freedom later.

The statement is provided to you by Financial Samurai (“Promoter”) who has entered into a written referral agreement with Empower Advisory Group, LLC (“EAG”). Click here to learn more.

Read the full article here