As I sadly watch my stock portfolio correct by over 10%, I find serenity in my paid-off home. No matter how much the stock market tanks, it’s comforting to know I’ll always have shelter to take care of my family.

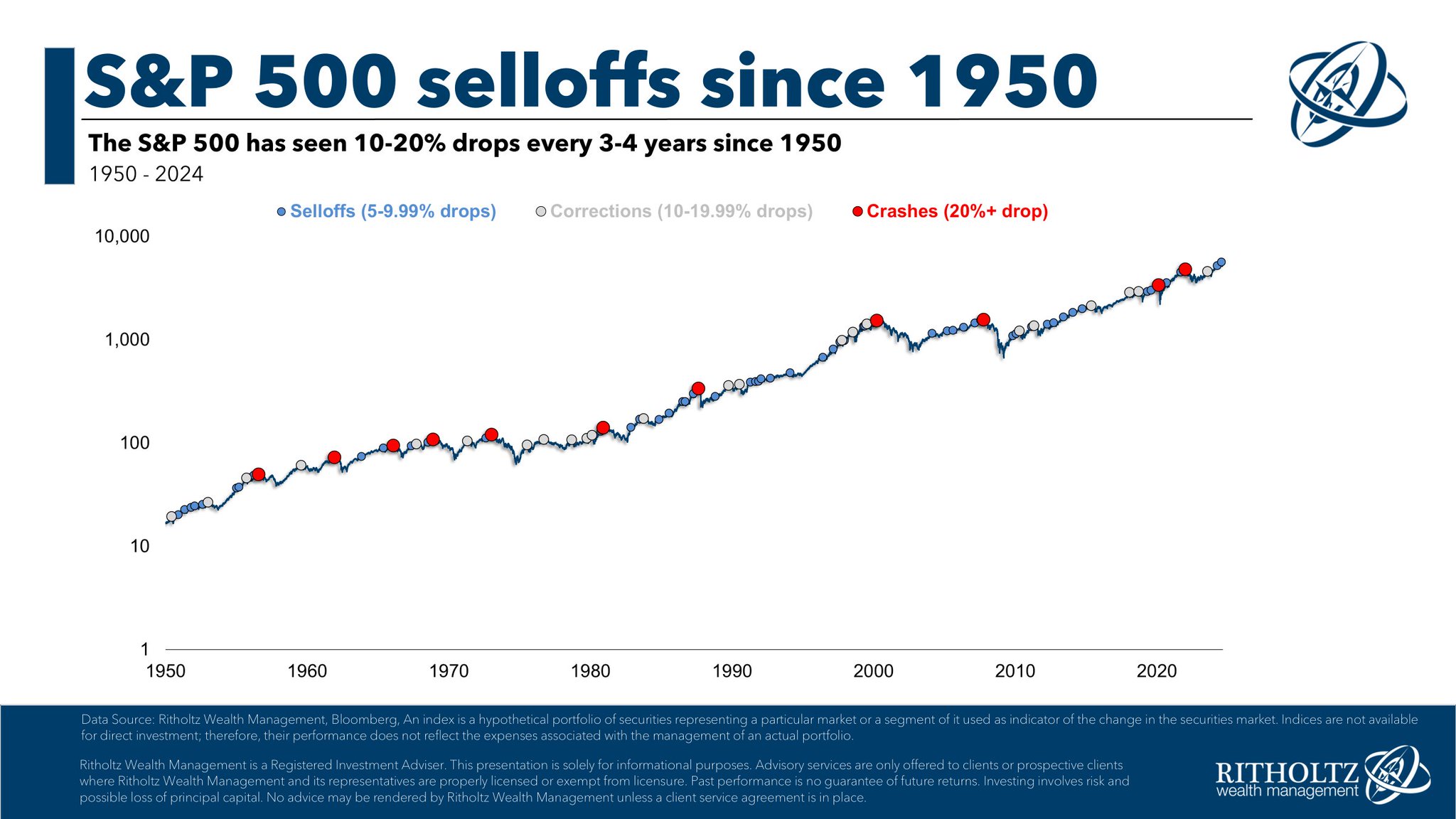

It’s funny, but only active investors, people in charge of their family’s investments, or personal finance enthusiasts may feel a heightened sense of stress during stock market corrections. If you practice buying the dip, as I always do, it can feel like repeated mental warfare as the stock market keeps dipping, making you feel like a fool.

But for my wife, who doesn’t regularly follow the stock market, this latest correction has had little effect on her mood. Meanwhile, my young kids are blissfully unaware of the rising risks of a recession and the looming mass layoffs. They just want to play and have fun.

For me, I’ve had to work hard to not let three weeks of non-stop stock market declines negatively affect my mood with my family. It hasn’t been easy, as I’ve found myself being less patient than usual. This latest discomfort is a good reminder of why I prefer real estate over stocks to build wealth.

If you are responsible for your household’s finances and don’t enjoy losing a lot of money quickly in the stock market, consider paying off your house. I’ve paid off several houses over the past 10 years, and I’ve never regretted any of them.

The Value Of A Paid-Off Home Is Greater Than Just Money

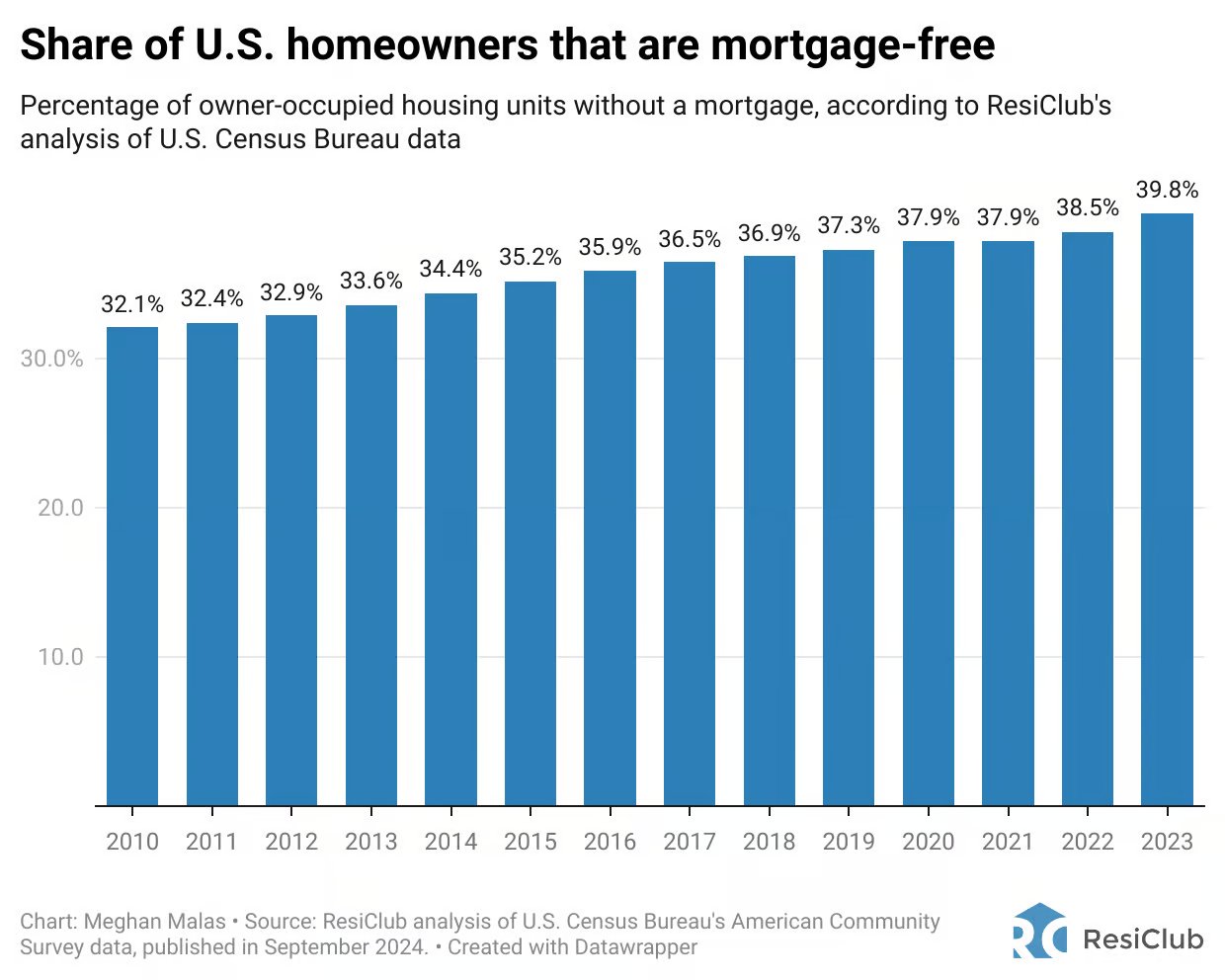

When mortgage rates are low, some people like to make fun of those with paid-off houses. Even though ~40% of homeowners have no mortgage, these critics somehow think those without one are foolish. “You could make a lot more money in stocks and other investments by having a mortgage!” is their most common criticism.

While it’s certainly true that leveraging a mortgage can lead to greater potential returns, critics fail to recognize the value a paid-off house provides: reduced stress and greater peace of mind. The older I get, the less I want to owe financial institutions money. Instead, I want to simplify my life with fewer bills and less debt.

To me, the feeling of financial security is worth far more than potentially earning an extra 4-8% a year on my investments. And that’s assuming things go well. Sometimes, investments underperform cash, Treasury bonds, and real estate. Sometimes, you can even lose a lot of money instead.

Those Who Criticize Homeowners Without A Mortgage

What I’ve also realized about people who mock those with paid-off homes is this: How many of them could afford to pay off their homes themselves? I doubt it’s more than 50%. After all, one of the main reasons people invest is to eventually buy and pay off a home.

So maybe those who criticize homeowners without mortgages secretly want to be mortgage-free too but don’t have the means. And because they can’t pay off their own homes, the only thing left to do is criticize those who have. Such is human nature – trying to bring others down to elate their own status.

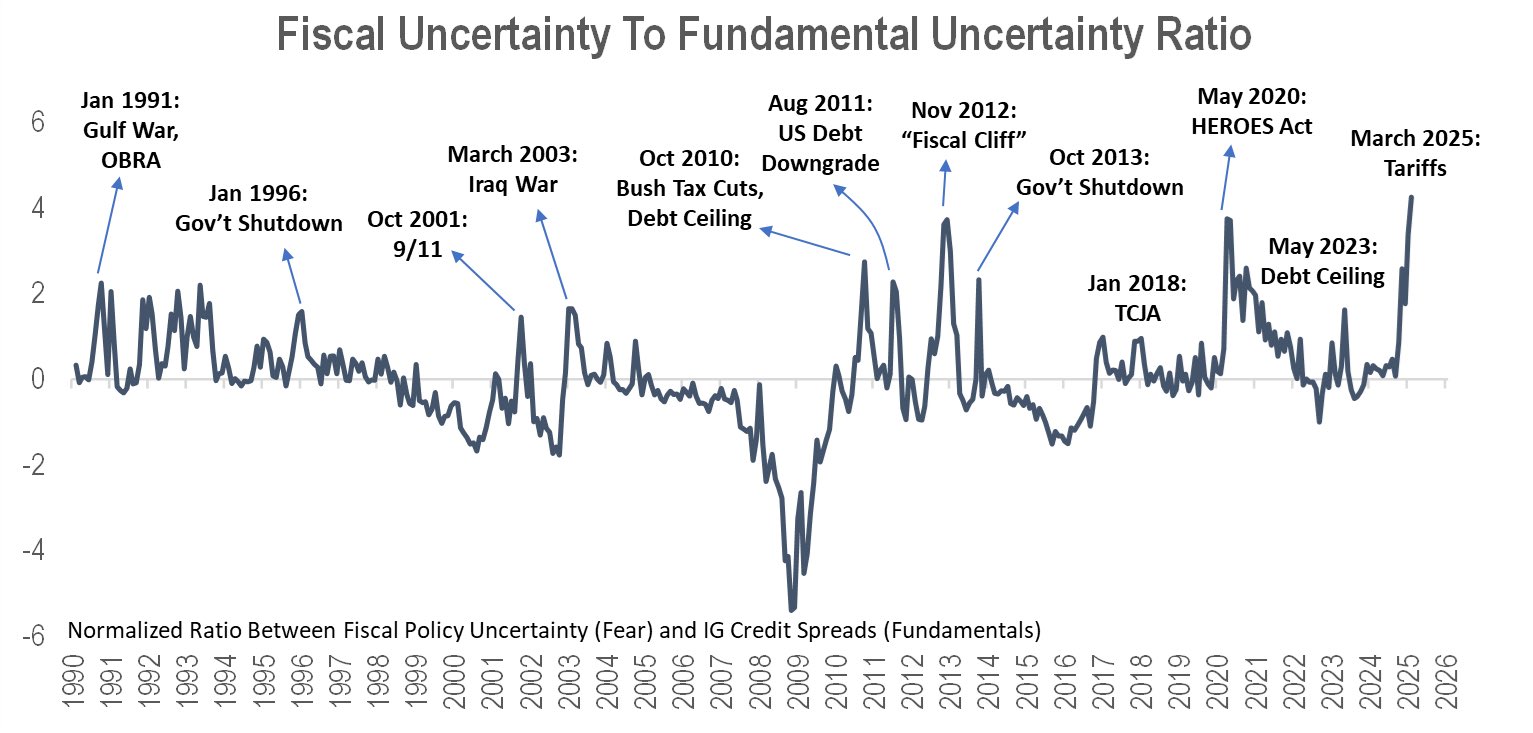

As the percentage of your home equity rises, your feeling of financial uncertainty declines. In fact, the more certainty you feel, the more confidence you will have in buying the dip when uncertainty is highest. When that final mortgage payment is made, the feeling of financial achievement is priceless.

A Paid-Off Home Can Appreciate as Well

Here’s the thing about your home, it can make you money or save you from losing a lot of money as well.

In normal times, real estate tends to appreciate by 4-5% annually. Sure, that’s lower than the S&P 500’s historical 10% return. But 4-5% appreciation on a large investment can generate a far greater absolute return than what your stock portfolio delivers. And if you take on mortgage debt, the cash-on-cash return is higher.

During downturns, real estate tends to hold its value well as investors seek the safety of bonds and tangible assets that generate income. Instead of appreciating 4-5%, real estate might only rise 0-2%, while stocks could easily decline 5-20%. However, since you’re not paying rent, your effective return is actually higher by the market rental yield.

Finally, in severe downturns, both real estate and stocks decline. But while residential real estate might drop 20% over several years in a realistic worst-case scenario, stocks can crash 50% within months. And yet, since homeowners aren’t checking a daily ticker symbol, the experience feels far less stressful.

When you own a paid-off house, appreciation rates—whether up or down—don’t affect you as much. Instead, your focus is on living your best life while pushing money into the background. After all, the end game for investing in stocks is to make a profit to buy something, like a house.

A Paid-Off Home Gives You Confidence To Live Better

We all need food, clothing, shelter, and transportation. If we can lock in our shelter costs, everything else becomes much more affordable. And if you take it a step further by fully paying off your house, you’ll find yourself living with greater confidence and freedom.

Want to take a sabbatical? Go for it! Dying to leave your job for one that fits your passions but pays less? No problem. Want to aggressively buy the S&P 500 dip? You bet.

Yes, over the long run, investing in stocks will likely generate greater returns. That’s why the vast majority of homeowners invest in stocks as well. But during downturns and recessions, a paid-off house shines the brightest. If you have one, embrace it. If you don’t, recognize its value.

I certainly don’t want our economy to collapse. Financially, I’d love nothing more than for stocks to rebound and outperform my real estate portfolio. But if that’s what it takes for egg prices to drop and for our aluminum and steel industries to be saved, then so be it. Those with paid-off houses will be far better off than those without.

Related: The Psychology Of Paying All Cash For A House

Questions And Suggestions

Do any of you have a paid-off house? If so, how do you feel about being mortgage-free during stock market corrections and economic slowdowns? As you’ve gotten older and wealthier, have you found yourself less focused on always maximizing profits? Why do some people with mortgages criticize homeowners without one?

Invest in real estate without the burden of a mortgage, tenants, or maintenance with Fundrise. With almost $3 billion in assets under management and 350,000+ investors, Fundrise specializes in residential and industrial real estate. I’ve personally invested $300,000 with Fundrise to generate more passive income. The investment minimum is only $10, so it’s easy for everybody to dollar-cost average in and build exposure.

To expedite your journey to financial freedom, join over 60,000 others and subscribe to the free Financial Samurai newsletter. Financial Samurai is among the largest independently-owned personal finance websites, established in 2009. Everything is written based on firsthand experience and expertise.

Read the full article here