Unlike most people, I love ARMs, or adjustable-rate mortgages. Adjustable-rate mortgages have helped me save over $300,000 in mortgage interest expense since 2005 compared to if I had taken out 30-year fixed-rate mortgages.

Despite all the fear, uncertainty, and doubt surrounding ARMs, they have been one of the most powerful wealth-building tools in my financial life. By taking advantage of lower introductory rates and paying down principal whenever there’s free cash, I have consistently reduced interest expense while maintaining flexibility.

in this post, I have a perfect case study that addresses one of the biggest fears of people getting an ARM: What if interest rates are much higher once the introductory fixed rate period is over? Isn’t the ARM holder going to pay the price and regret not getting a 30-year fixed rate instead?

I’m convinced that much of the fear, anxiety, and even hostility we experience comes from not fully understanding the situation at hand. The more deeply we understand an issue, or a person, the less room there is for fear and hate.

Now let’s get started you open-minded, loving people.

My Expiring 7/1 ARM

Sadly, a 7/1 ARM I closed on in December 2019 is finally going to reset in December 2026.

Back in 2019, I refinanced my expiring $700,711 5/1 ARM at a 2.5 percent rate into a 7/1 ARM at a 2.625 percent rate. At the time, I could have locked in a 30-year fixed-rate mortgage at about 3.375 percent. However, the spread between the ARM and the fixed-rate mortgage was too wide to be enticing. I also knew I would not keep the mortgage for anywhere close to 30 years. This was a fixer upper I bought in 2014 that was large enough for a family of three, but not ideal for a family of four.

Fast forward to today, and the mortgage balance stands at roughly $379,000, or about 45 percent lower than when I first refinanced in 2019, and $615,000 lower than the original amount in 2014. Frankly, I thought the balance would be even lower by now. However, when COVID hit in 2020, I decided to stop making extra principal payments and instead use the capital to buy the dip in risk assets.

That decision turned out to be financially rewarding, but it also meant slower mortgage amortization than initially planned.

As luck would have it, I do not have $360,000 lying around to pay off the mortgage before it resets in December 2026. I have already earmarked about $100,000 for capital calls in private closed-end funds. I also want to continue dollar-cost averaging into public equities and at least another $50,000 in Fundrise Venture for my children.

So the question becomes one that many ARM holders will face over the next few years.

What should you do with an expiring ARM, especially when interest rates today are materially higher than when you first took it out?

What To Do With an Expiring ARM

There are really only three options when an ARM reaches the end of its introductory fixed-rate period.

- Pay it off

- Refinance it

- Let it adjust

Because I never want to go through another mortgage application or refinance again if I can help it, refinancing is my least attractive option. I could sell assets to pay off the mortgage, but doing so would trigger capital gains taxes that I would rather avoid.

That leaves me with two realistic choices: pay it off slowly or let it adjust and manage the higher rate and payment intelligently.

After running the numbers, letting the ARM reset is the most logical decision. I believe it is the most logical decision for most people facing the same dilemma.

1) ARMs Have Rate Reset Caps and Lifetime Caps

One of the most misunderstood aspects of adjustable-rate mortgages is how rate increases actually work.

Before making any decision, I reached out to my mortgage officer to confirm the exact interest rate caps on my loan. My ARM has both an annual adjustment cap and a lifetime cap.

The maximum increase allowed at the first reset is 2 percent. The lifetime interest rate cap is 7.65 percent.

That means in the worst-case scenario, my interest rate would rise from 2.65 percent to 4.65 percent in December 2026 for the next 12 months. Even at 4.65 percent, the rate would still be about 1.35 percent lower than today’s average 30-year fixed-rate mortgage of roughly 6 percent.

Given this reality, the logical conclusion is to let the ARM adjust and reassess after the first year.

After the initial reset, the rate can adjust annually, again subject to a 2 percent cap per year. If mortgage rates stay elevated or rise further, I could theoretically end up paying a 6.65 percent mortgage rate in year nine of the loan (second year after adjustment).

By historical standards, a 6.65 percent mortgage rate is not terrible. It is close to the long-term average for U.S. mortgages. However, I think there is a good chance the second-year adjustment will be smaller than the full 2 percent cap.

If mortgage rates remain where they are today, the increase in year nine may only be about 1.5 percent, taking the rate to roughly 6.15 percent. If rates decline, the increase could be even less.

The key point is this: there is no urgency to act today. Waiting until the end of the first adjustment year provides far more information and flexibility.

2) Your Mortgage Payment Can Decline Even If the Rate Rises

The second and arguably most important thing to analyze when facing an ARM reset is not the interest rate itself, but the resulting monthly payment amount.

Here are my mortgage assumptions.

The loan is a $700,711 7/1 ARM structured as a 30-year amortizing mortgage originated in December 2019. When it resets in December 2026, there will be 23 years, or 276 months, remaining.

- Remaining balance: $379,000

- Current monthly mortgage payment: $2,814

- New rate for one year: 4.65 percent

- Monthly rate: 0.0465 divided by 12

- Remaining term: 276 months

My current monthly principal and interest payment is $2,814, with about $1,984 going toward principal and $830 toward interest.

After the reset, the new monthly payment would be approximately $2,238. That is $576 less than my original $2,814 payment when the loan was first originated. The reason is simple. I crushed the principal balance by 45 percent over the first seven years of the ARM.

Here is how the first month after reset would break down for my new $2,238 mortgage fixed for one year.

- Interest: approximately $1,469, which is about $630 more per month

- Principal: approximately $769, which is about $1,213 less per month

- Total payment: approximately $2,238

Emotionally, it feels bad to see more money going toward interest and less toward principal. However, the big picture is far more important than the month-to-month optics.

The Big Picture Takeaway on ARM Resets

Even though my interest rate jumps by a full 2 percent, my monthly payment still declines materially from $2,814 to $2,238.

At a sub-$400,000 balance, the ARM reset risk is largely neutralized.

If the rate were to rise another 2 percent in year nine (2nd year of reset), and assuming normal amortization, my monthly payment would increase to roughly $2,665, with about $2,050 going toward interest. That scenario would not be ideal, but it would still be manageable. The monthly payment is still $149 lower than my original mortgage for seven years of $2,814.

This is a textbook example of how aggressive early principal paydown turns future rate risk into a non-event.

3) Compare Your Mortgage Rate to the Risk-Free Rate

A 4.65 percent mortgage rate is still relatively low in absolute terms. However, it is now higher than the risk-free rate of return as measured by the 10-year Treasury yield.

When your mortgage rate exceeds the risk-free rate, the math becomes straightforward.

Any cash that would have gone into U.S. Treasuries should instead go toward paying down the mortgage. A guaranteed 4.65 percent return beats a guaranteed 4.2 percent return, for example. Of course, you need to still be aware of your liquidity needs as extracting liquidity out of a property can be more expensive.

Because my payment drops by $576 per month after the reset, I plan to keep paying at least the original $2,814 amount during the first year of adjustment. Doing so allows me to apply an extra $576 per month toward principal while remaining cash-flow neutral.

In addition, because the mortgage rate is higher than the risk-free rate, I will likely pay down at least an additional $20,000 in principal that year. That amount roughly matches what I would have otherwise invested in Treasuries.

Before the first year of adjustment ends, I will run this entire analysis again with updated rates, balances, and opportunity costs. So should you.

Let Your ARM Reset and Keep Paying Extra Principal

After going through this exercise, I believe most ARM holders facing higher interest rates should strongly consider letting their ARM reset and continuing to pay down extra principal strategically.

This approach minimizes friction, avoids refinancing costs, preserves optionality, and often results in the lowest total interest expense. The first year of the new rate could very well be materially lower than existing mortgage rates.

Refinancing can make sense if mortgage rates drop meaningfully. Refinancing a mortgage can easily take 30 to 60 days, involve a mountain of paperwork, and cost up to 1% – 2% of the loan balance. For most people, that is a costly and time-consuming pain.

Therefore, I would only refinance if the breakeven period is 18 months or less. The average homeownership tenure is only about 12 to 13 years, which means many homeowners overestimate how long they will actually benefit from a refinance.

Once you have enjoyed your introductory ARM period, realism matters more than theory. Overestimating how long you’ll own a home by 17-18 years by getting a 30-year fixed rate mortgage at a higher rate is a suboptimal move for your finances.

An ARM Helps Me Boost Semi-Passive Income and Stay Free

Ultimately, I am satisfied my ARM is resetting by 2 percent while my monthly mortgage payment drops by $576.

This matters because I recently increased rental income on this property by $3,500 per month after renting out the entire home at market rates following tenant turnover. In the past, only the upstairs was rented out and the tenant had been there since the end of 2019 until mid-2025.

As a result, for this one property alone, my annual semi-passive income increases by $48,912 despite the higher interest rate.

I originally purchased the property in 2014 and lived in it for six years after fixing it up. It served as a wonderful home when it was just my wife and me, then when our son was born in 2017. It has appreciated decently, and is now a core part of our retirement income strategy.

Getting an ARM made it easier to buy the property in the first place. Keeping an ARM allows me to keep payments low while maintaining flexibility until the loan is gone.

My goal is to pay off the property by 2030, or within 16 years of purchase. That requires paying down an extra ~$50,000 in principal per year over the next five years. I am confident it will happen because I’ve now planned it out.

If I were a first-time homebuyer or purchasing another long-term property today, I would absolutely consider a 7/1 ARM or 10/1 ARM again. Over seven to ten years, at least 15 percent of the principal will be paid down, and there is a meaningful chance you move or sell before the ARM ever resets.

A 30-year fixed-rate mortgage provides peace of mind, but once you walk through realistic life scenarios, you may find that an ARM offers a better balance of savings, flexibility, and control.

Reader Questions

- If your ARM were resetting today, would you rather let it adjust or refinance for psychological peace of mind, even if it cost more?

- How aggressively did you pay down principal during your ARM’s fixed-rate period, and how does that affect your reset risk?

- Would you choose an ARM again for your next home purchase, or has today’s rate environment changed your perspective?

Invest In Real Estate Passively Without The Headaches

Although physical rental properties generate most of my retirement income, managing rentals is becoming a growing pain. As a result, I have been gradually selling my rental properties and redeploying the capital into private commercial real estate for fewer headaches and more peace of mind.

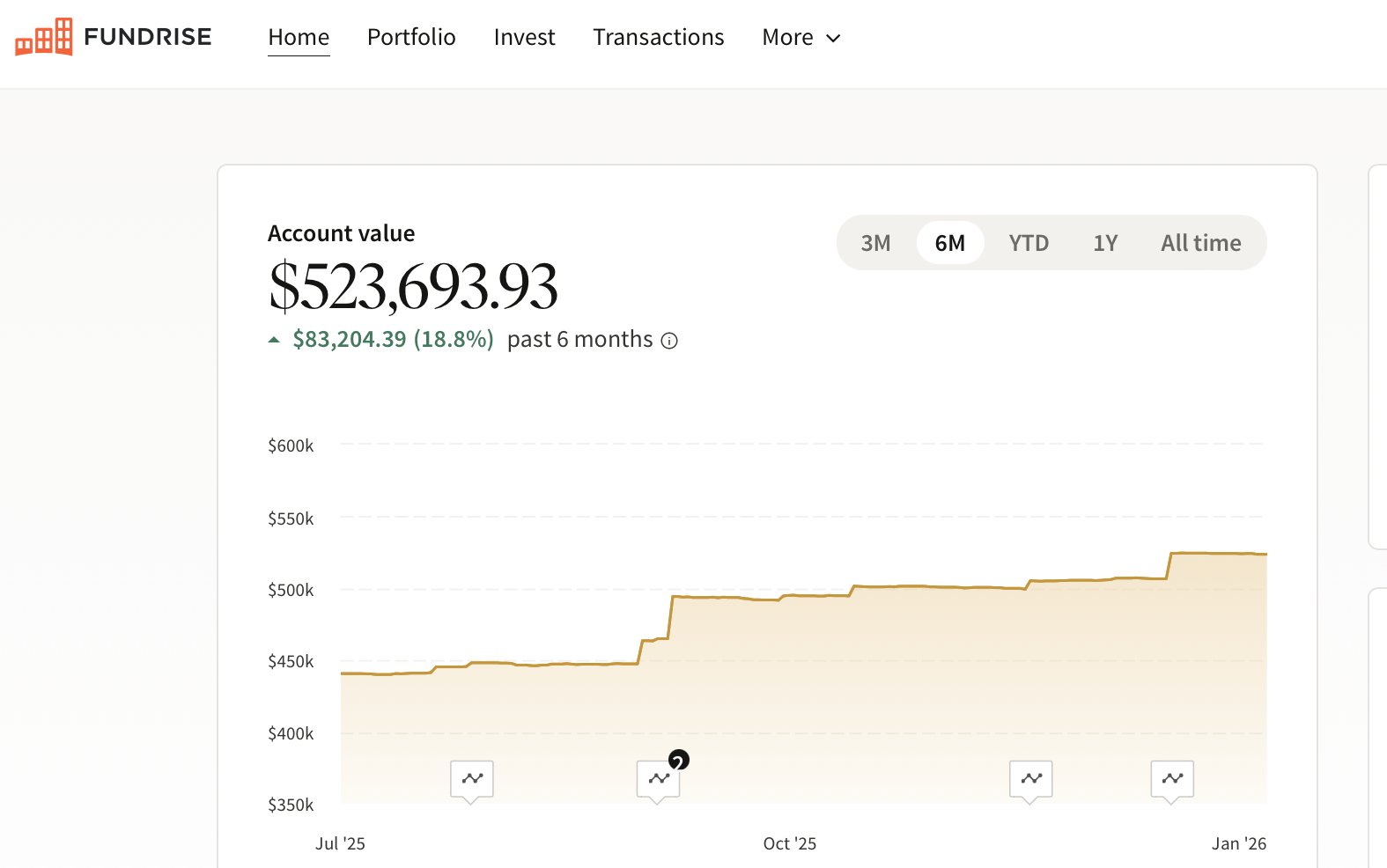

Consider Fundrise, a platform that allows you to 100% passively invest in residential and industrial real estate. With over $3.5 billion in private real estate assets under management, Fundrise focuses on properties in the Sunbelt region, where valuations are lower, and yields tend to be higher.

In addition, you can invest in Fundrise Venture if you want exposure to private AI companies. AI is set to revolutionize the labor market, eliminate jobs, and significantly boost productivity. We’re still in the early stages of the AI revolution.

I’ve personally invested over $500,000 with Fundrise, and they’ve been a trusted partner and long-time sponsor of Financial Samurai. With a $10 investment minimum, diversifying your portfolio has never been easier.

To increase your chances of achieving financial independence, join 60,000+ readers and subscribe to my free Financial Samurai newsletter here. Financial Samurai began in 2009 and is a leading independently-owned personal finance site today. Everything is written based off firsthand experience.

Read the full article here